Listening to the Prez talk about the current financialocalypse got me thinking about the

Great Depression (it was neither great nor depressing...discuss!) and what, if any, markets thrived during that global economic buzz kill. Turns out, a lot did. Most are pretty obvious, but if we’re looking to roll in new clients during the recent unpleasantness, these might be sectors to watch:

FOOD. People still eat (well, most of them) regardless of income and even when foregoing health care expenses. The classic Depression-era example is Kelloggs out-marketing Post.

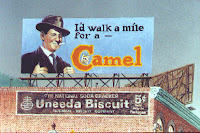

HOUSEHOLD PRODUCTS / ESSENTIAL CONSUMABLES. People still need soap and solvents and diapers and gasoline and stuff. P&G is the stand-out Depression-era success in this category. For that matter, so are perceived essentials. Camel almost destroyed Lucky in the 1930’s because people needed cigarettes. In our epoch, maybe people need coffee like they once needed cigarettes (the perfect opportunity for Jittery Joe’s to destroy Starbucks?).

COMMUNICATIONS. Print and radio boomed during the depression. Now, this certainly isn’t the case any longer. But those communications markets that are now replacing them might be. I am, reminded of a friend of mine who recently got laid off who canceled his cable but not his Internet or cell services, because he needs those to work from home and, in the case of his internet, to watch conventional TV programming.

CAPITAL GOODS. While the new production of capital goods during the Depression was almost zero, the resale value of them appears to have gone up. Nowadays, there are a lot of factories out there looking to sell off their means of production – someone must be handling that transaction. You can bet that if the stimulus package hits, and infrastructure projects go up despite Caterpillar's reduced production, that a market for related, resold parts will emerge.

MILITARY / GOVERNMENT.

MILITARY / GOVERNMENT. Perhaps this goes without saying. But we’re fighting two wars and, even if we pull our combat troops from Iraq, those Humvees are still gonna need tires and those marines are still gonna need armor for a long time. And with Black Water kicked out of the country, other US security companies have the opportunity to rush in and fill that branding black hole. While some departments of the government (NASA, NEA, etc) might get their budgets slashed, you can bet the DoD and the DoS won’t be among them. After all, it wasn’t the New Deal that ended the Great Depression. It federal spending and bond investment for WWII.

SECURITY. The simplest arithmetic of the Depression, or any recession: As the economy goes down, crime goes up. Dekalb county, Georgia just this week announced it will be spending $1million on tasers for it's police, despite budget shortfalls. Security consultants aren't only needed overseas and, as the recession lingers, may become more valuable domestically.

ANYONE WHO KEEPS ADVERTISING.

ANYONE WHO KEEPS ADVERTISING. This is the single greatest economic truism of the depression. Generally speaking, those companies that not only survived but did well and grew during the Great Depression weren’t representative of any one marketplace but, rather, were those that continued to act as though there was nothing wrong and that the public had money to spend on their service/product. And they advertised. Alternately, companies that cut spending during that era actually dropped out of public sight, causing customers to feel abandoned and to associate the effected brands with a lack of staying power. This drove customers to more aggressive competitors and appears to have caused a certain amount of financial mistrust when it came to spending money with the no longer visible companies.

Who says a history degree is useless. Just wait ‘til Germany invades Poland again and you’ll see what I mean (‘cause you know they will...)

FB

To say that most Americans don't understand the current financialocaplyse is, perhaps, an understatement. Confusion abounds concerning mortgage-backed securities, sub-prime mortgages, and the crippled condition of the banking system. And try as they might, most media outlets—however thorough or complete their coverage—fail to capture the problem in an easily digestible and understandable form.

To say that most Americans don't understand the current financialocaplyse is, perhaps, an understatement. Confusion abounds concerning mortgage-backed securities, sub-prime mortgages, and the crippled condition of the banking system. And try as they might, most media outlets—however thorough or complete their coverage—fail to capture the problem in an easily digestible and understandable form.